Recent Posts of Platform selection

03 December, 2013

In the early stages of new technology markets, a lot of services are created because new technology has made new ways of doing things possible. Where app developers go, apps and then users will follow. By looking at the popularity of various device APIs across platforms, we can see which developers are making the most of the capabilities their devices offer. If we then look at the device APIs that developers say the plan to adopt, we can see future trends in the app market, possibly months before the apps start to appear. Would it be wise to move against the herd, or is the trend really your friend?

23 November, 2013

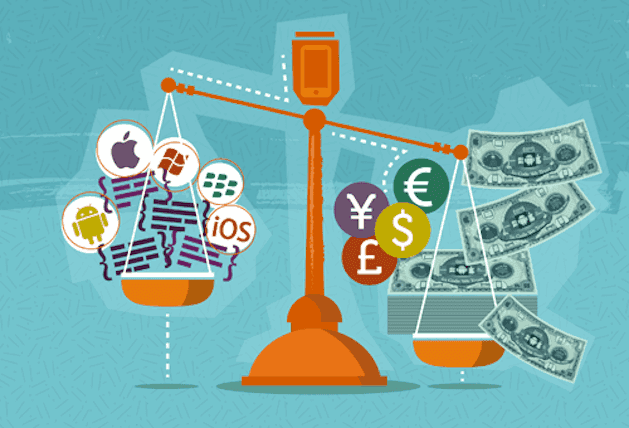

Although the debate on HTML5 versus native apps seems to be favouring native apps currently, particularly in terms of user experience and performance, average developer revenues tell a very different story. Our survey data shows the mean average revenue for developers who consider HTML5 for mobile devices their primary platform is the highest of all platforms, just over twice that of the next nearest (iOS)*. However, the rewards are very unevenly shared, with the median average revenue for the same developers under half that of their iOS counterparts. Diving into the data we can see significant differences in revenue depending on how mobile apps built with web technologies are delivered to users and the categories they target. Understanding these differences could improve your chances of succeeding with HTML5.

07 October, 2013

The mobile apps business is maturing and while most of the media attention is still focussed on the latest app store success stories, developers are finding lots of better ways to make revenue with their apps. Considering all revenue sources, which categories of application are generating the most money and what’s the competition like on each platform?

12 September, 2013

On desktop computers web apps have come to dominate many application categories. They are easier to develop and deploy across multiple platforms and it’s possible to iterate much faster. A very large number of developers would like to be able to apply the same technologies and techniques on mobile devices but very few are able to do so successfully, particularly for mass market consumer apps. One of the most important reasons for this is performance. Resolving this issue is much more about politics than technology.

07 June, 2013

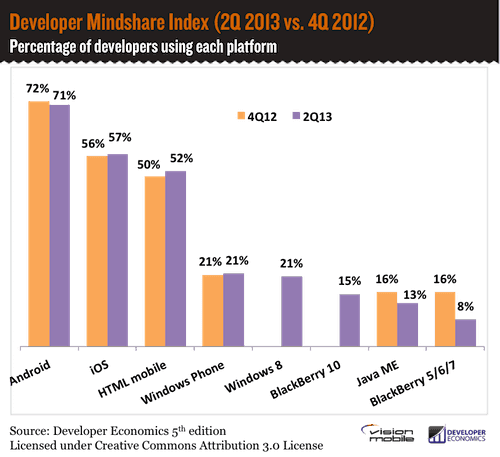

We’ve just completed the largest developer survey to date and the results are starting to come in. Marketing Manager Matos Kapetanakis discusses some early insights, focusing on platform mindshare and the role of HTML5.

09 April, 2013

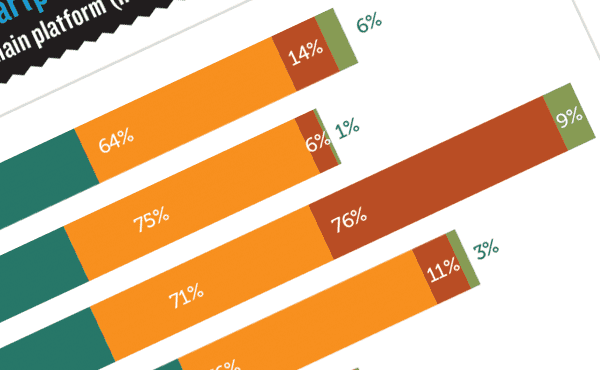

How do app developer revenues vary by country, or platform? Does the number of platforms make a difference to app revenues? Which models bring in the most revenues? We revisit Andreas Pappas’ November analysis of app monetisation with more insights from our Developer Economics 2013 survey across 3,400+ developers.

08 March, 2013

Last year was quite a bad one for HTML5 in terms of developer mindshare. At the end of 2011, developer sentiment seemed to favour a shift away from native and towards HTML5 for a large range of application categories. As the year went on, there were more horror stories than…

28 February, 2013

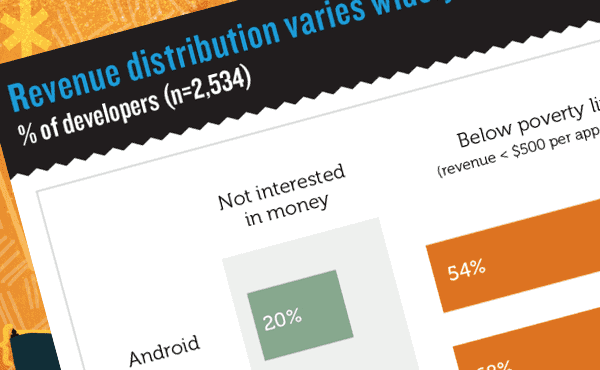

While not all developers are in it for the money, most would like their apps to provide an income and the majority of those struggle to earn revenues that will sustain further development. We defined $500 per app per month as a reasonable global “poverty line”, in some countries this is very low while in […]

22 February, 2013

One of the most common mistakes developers make when planning the business case for a new app is dramatically overestimating the number of users they will be able to attract, particularly for their first app. The typical argument goes something like this: “My app will be compatible with 400 million devices, if I can reach just 1% of those, that’s 4 million users”. The trap here is…

21 February, 2013

In our latest developer survey we asked developers about the different screens they target. The results show smartphones are the most popular target, whilst tablets are catching up fast. PCs are most commonly targeted by web developers while TVs are still a niche app market for all developers.

Contact us

Swan Buildings (1st floor)20 Swan StreetManchester, M4 5JW+441612400603community@developernation.net